The final three members of a money laundering gang which also stole £10m of UK taxpayers’ money after taking advantage of a covid loan scheme, have been sentenced.

It means the the full story of a case that illustrates just how easy it was to exploit a scheme aimed at supporting small businesses struggling during the pandemic can be told.

In 2020, the gang used scores of bogus companies to take advantage of the then-Chancellor Rishi Sunak’s Bounce Back Loan scheme.

Any small company could apply for up to £50,000 of taxpayers’ money but, in the rush to save the economy, checks on borrowers were limited.

In fact, the gang’s £10m is only a drop in the ocean. The National Audit Office estimates the taxpayer could lose billions of pounds in Bounce Back Loan fraud.

The latest convictions – bringing the total number to 10 – are a good result for the Organised Crime Partnership, a joint unit made up of the National Crime Agency and Met Police.

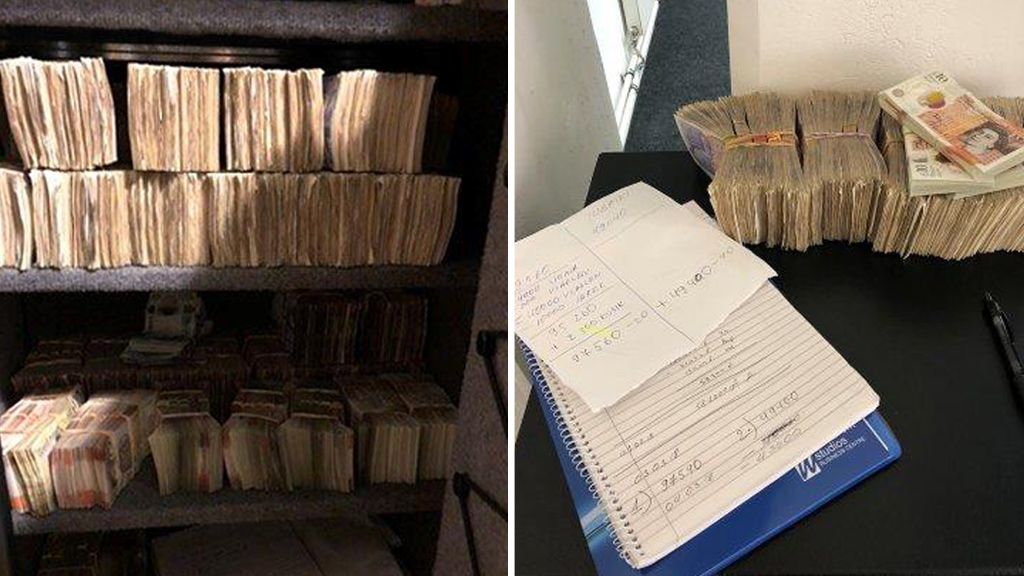

It’s thought the gang laundered as much as £70m. But only £181,600 of the money has been recovered and it’s believed other offenders involved in the fraud are still at large.

The gang were able to steal so much money because long before covid, its ringleaders had already established a network of bogus companies to launder cash from VAT fraud and other criminal activities, including drug dealing and construction scams.

But when the pandemic struck, Artem Terzyan, a Russian, and Deivis Grochiatskij from Lithuania, who had been on the NCA’s radar since 2017, suddenly found themselves with a reduced income.

As the world locked down, criminals were hit just like legitimate businesses. The pair realised they had to diversify, targeting the UK Government Bounce Back Loans emergency scheme which saw more than 1.5 million loans worth nearly £47bn approved.

The men bagged £10m – they applied for the cash claiming their bogus companies were in danger of going bust.

But they got careless. As well as the loan cash, they continued to launder other money, all under the noses of the NCA.

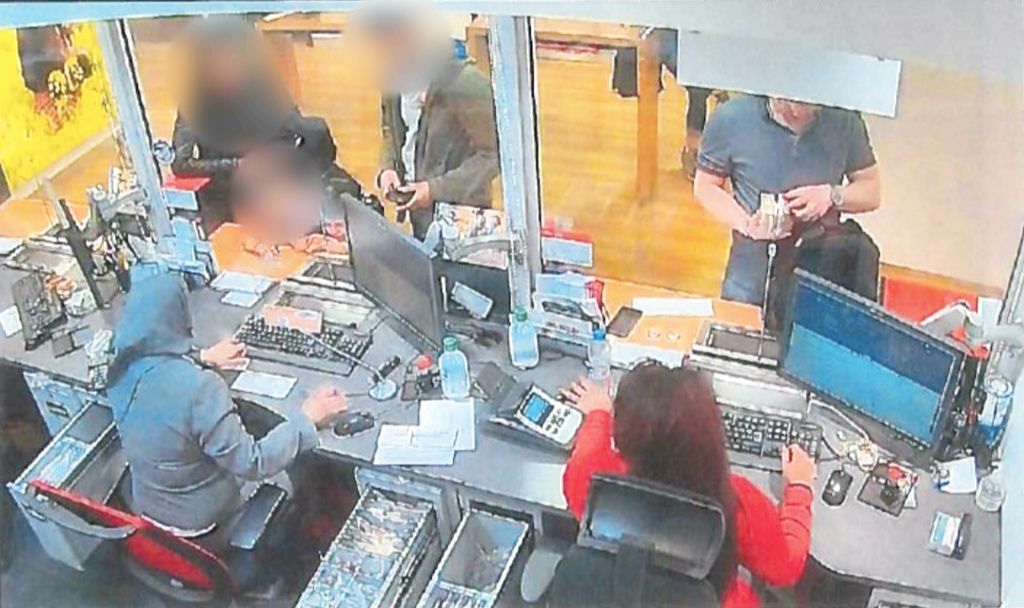

So when officers arrested them again in November 2020, they found overwhelming evidence of wrongdoing.

At their trial in December 2021, the court heard how both men had used the money to buy high-end watches, foreign holidays and cars. The rest of the cash had been transferred immediately abroad.

The NCA’s John Coles says usually only lottery winners could suddenly spend money so freely.

“These people won the lottery in a totally different way.”

In December 2021, Terzyan and Grochiatskij were jailed for laundering as much as £70m and stealing £10m in Bounce Back Loans. Terzyan is serving 17 years – and Grochiatskij, 16.

The last of three trials concluded on Friday at Kingston Crown Court, with the final three defendants receiving suspended sentences. It means reporting restrictions can now be lifted.

Each of Terzyan and Grochiatskij’s bogus companies that received Bounce Back Loan money in 2020 had a real person appointed as a director.

The BBC decided to trace two of these directors and find out if they had any idea where the money had gone.

Scouring court documents and the files of Companies House, the names of two of these bogus firms stood out – Bart Solution Ltd and JK Consult Ltd. The prosecution said they had been used to launder large amounts of money.

Just over £10m was paid into and out of the accounts of Bart Solution Ltd during 2020. The prosecution told the court most of this money came from Bounce Back Loans.

In court, JK Consult LTD was described as a “shell company” with no assets. Despite that, millions of pounds was deposited into its accounts and then sent on to other companies both in the UK and around the world.

The Companies House database also provided us with two names – each one a director of the two bogus firms. Povilas Bartkevicius was the name listed for Bart Solution Ltd – and Yekaterina Kobrina, the director of JK Consult Ltd.

By examining social media accounts the BBC learned that Mr Barkevicius is a chef, while Ms Kobrina is a model with thousands of followers on Instagram. Both have links to the capital of Lithuania, Vilnius, so the BBC went to try to track them down.

The BBC enlisted the help of BBC colleagues based in Vilnius, but a scan of local telephone and government online directories came up blank, with neither director listed.

Mr Barkevicius stopped posting on social media in 2021, but his final posts show he worked at an expensive restaurant just outside the capital.

The BBC rang the restaurant but were told that he was not working there, and they refused to give us his home address. They then became suspicious and wanted to know why the BBC were searching for him. It felt like a dead end.

So the BBC decided to get creative. Taking the user name of his Facebook and Instagram accounts, the BBC searched for him elsewhere online – Telegram and Tiktok. But with no luck.

Then the BBC tried the activity app Strava, which cyclists, runners and walkers use to track their progress. Remarkably, the BBCe found he had an account and that he had not set it to private.

It showed that in the summer of 2022, he cycled from the same location every morning and returned each evening. The BBC followed this trail back through the city to a Soviet-era block of hundreds of apartments – but which one was his?

The BBC then did more digging on Facebook and discovered he likes BMWs. In fact, he posted a picture of his car, asking members of a BMW owners’ group for help with a broken rear light. The BBC hunted around the car parks near the blocks and matched the photo online to his silver BMW. Bingo.

The following day the BBC were up in the dark at 05:30 – it was below zero and there was snow on the ground. The BBC drove to the block and parked near his car, waiting by the communal door.

Too cold to cycle, the BBC assumed he must now be driving to work. Within minutes, Mr Bartkevicius walked out of the block of flats and the BBC were there to greet him.

The BBC introduced ourselves and asked if he knew where the money in the bogus company he was linked to had gone. He seemed genuinely shocked to see us and confused by our question. He insisted he had no idea he had been a named director for Bart Solution Ltd.

He said he had read accounts of the court case in the papers but knew nothing about what the gang were up to before then.

“I heard that they were laundering money, but I didn’t know that they laundered £10m [in] my name,” Mr Bartkevicius told us.

He insisted he was in the dark about the loan money.

“If I had some money, even 10,000, I wouldn’t work two job,” he said. “I just married two months ago. I was working all weekends, just to be able to buy everything for my wedding.”

He maintained he had no idea what happened to the money. He has not been interviewed by the police in Lithuania or the NCA in the UK.

But what of the model Yekaterina Kobrina?

The BBC rang a clothes shop in Vilnius which she used to model for, to see if the BBC could book her for an assignment. But the owner was suspicious and wouldn’t help.

Ms Kobrina had posted a lot of photos on her social media of holidays in exotic places, but very little about her life in Vilnius.

Bizarrely though, after searching a whole range of local Facebook groups, one of her posts popped up in a group full of people angry about the poor quality of produce available in their local supermarket.

The BBC could see Ms Kobrina regularly complained about the state of the vegetables, especially the potatoes.

The BBC traced the shop to an area of grimy tower blocks in the north of the city. The BBC spent the next couple of days in the area trying to trace her. But it was only after a tip-off from a local BBC producer, that the BBC spotted her walking down a street.

She seemed surprised when the BBC approached her, but she shook hands, laughed and told me how nice it was to see me.

We asked her about the company she was a named director of – JK Consult Ltd – and if she knew where all the money from the Bounce Back Loans had gone.

Ms Kobrina told us: “I don’t have any answers, you can check that all my property is leased, I have huge loans. I don’t know anything. You should ask other people. Because I live in Vilnius, in Lithuania.

“No comments, only with my lawyer.” Then she drove away.

The BBC learned later that she had been interviewed by police in Lithuania, but had not been charged.

So, despite our efforts, the BBC were no closer to knowing whether Mr Bartkevicius or Ms Kobrina knew anything about the fraud or what their names were being used for.

One man who is not surprised by this story is Mike Craig, who has waged a one-man campaign to highlight problems with the loans.

His Twitter profile has tens of thousands of followers and his “Mr Bounceback” website tries to help legitimate firms.

The most recent government report estimated 8% of all Bounce Back Loans could be lost to fraud or error.

To date, 273 investigations have been launched – involving £160m of bogus loans. Forty-nine people have been arrested.

The Department for Business, Energy and Industrial Strategy said the government was “bearing down” on this fraud. A spokesman said: “The BBC are working with lenders, law enforcement, and partners across government to recover fraudulently-obtained loans. The BBC wholly support the Insolvency Service in penalising those who sought to defraud the scheme for their own financial gain.”

Mr Craig says the loan scheme was obviously vulnerable from the start – requiring no affordability or credit checks, which was “like a jackpot for a lot of people”.

“At the start I thought all you need for a Bounce Back Loan is an eligible company and a pulse. But it turns out you didn’t need either,” he says.

I ask him where that leaves the taxpayer? He replies, “Stuffed for billions of pounds”.

Source: bbc.co.uk

Be the first to comment